I am a Ph.D. candidate in Economics at New York University (NYU).

Prior to my Ph.D., I was a research analyst at the International Monetary Fund (IMF).

- Interests: Macroeconomics, Asset Pricing

- Email: dql204@nyu.edu

- I am on the 2025-2026 academic job market.

[CV]

Job Market Paper

Belief Distortions, Asset Prices, and Unemployment Fluctuations

[PDF] [Online Appendix] [Slides]

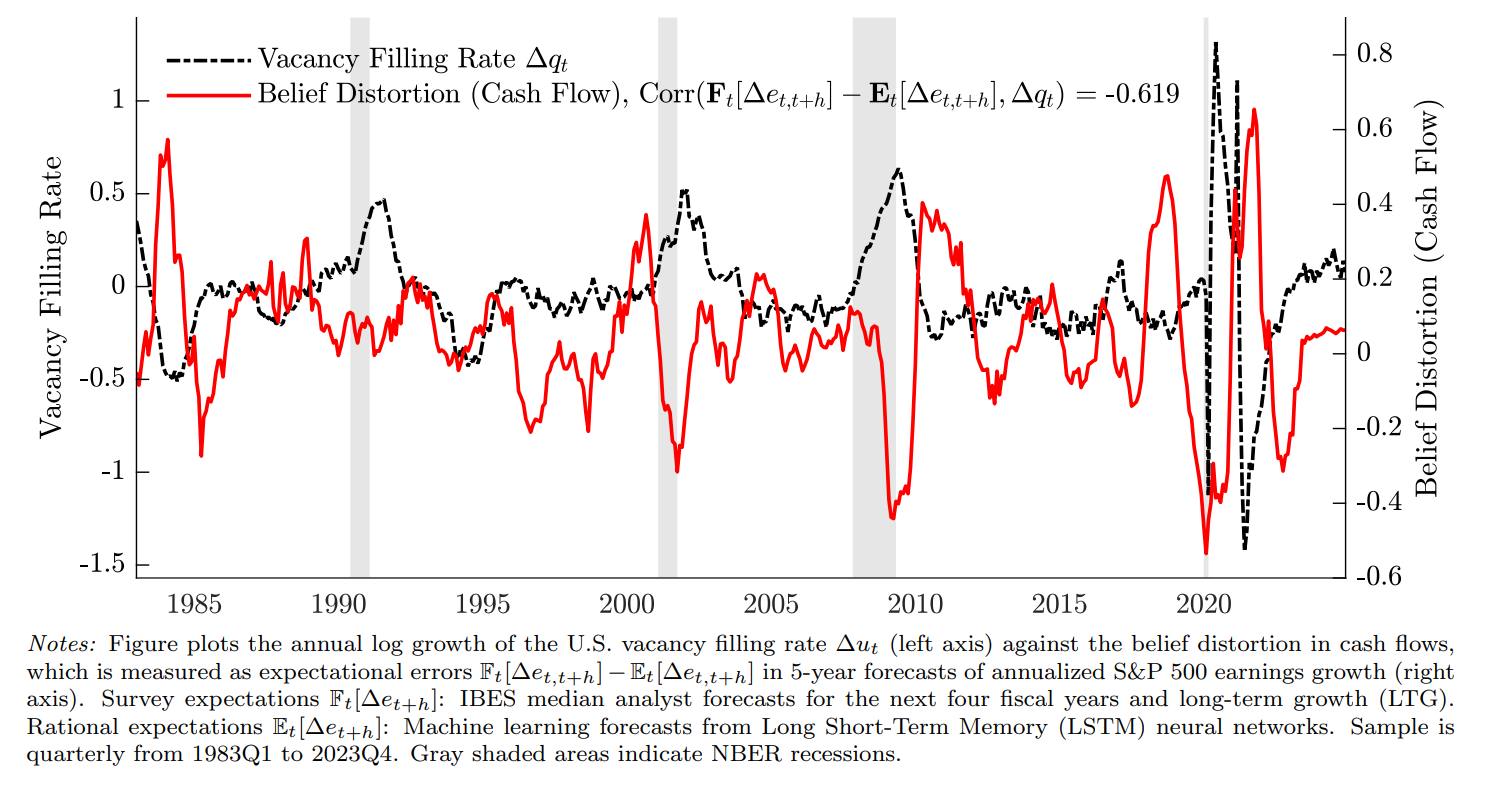

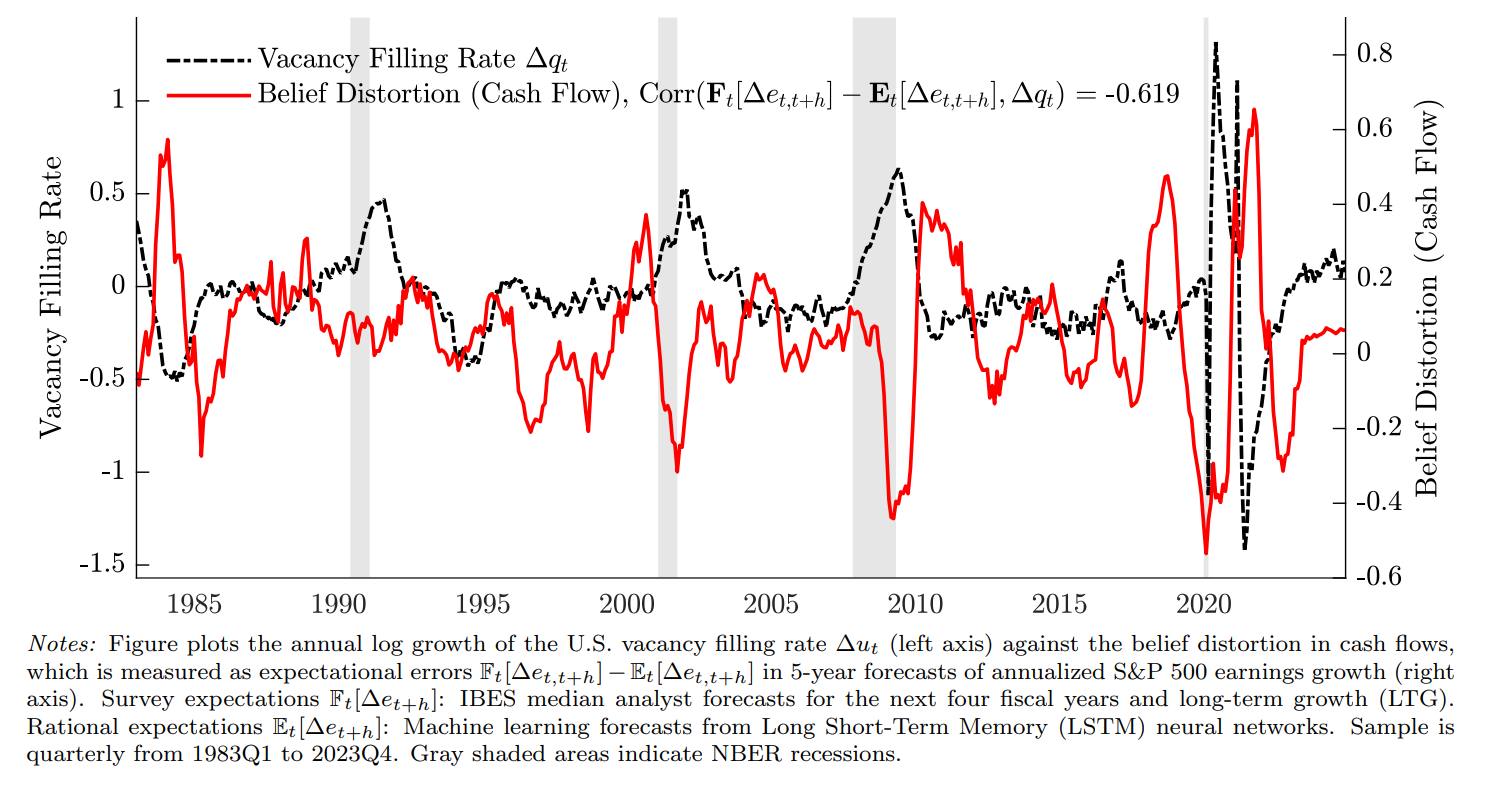

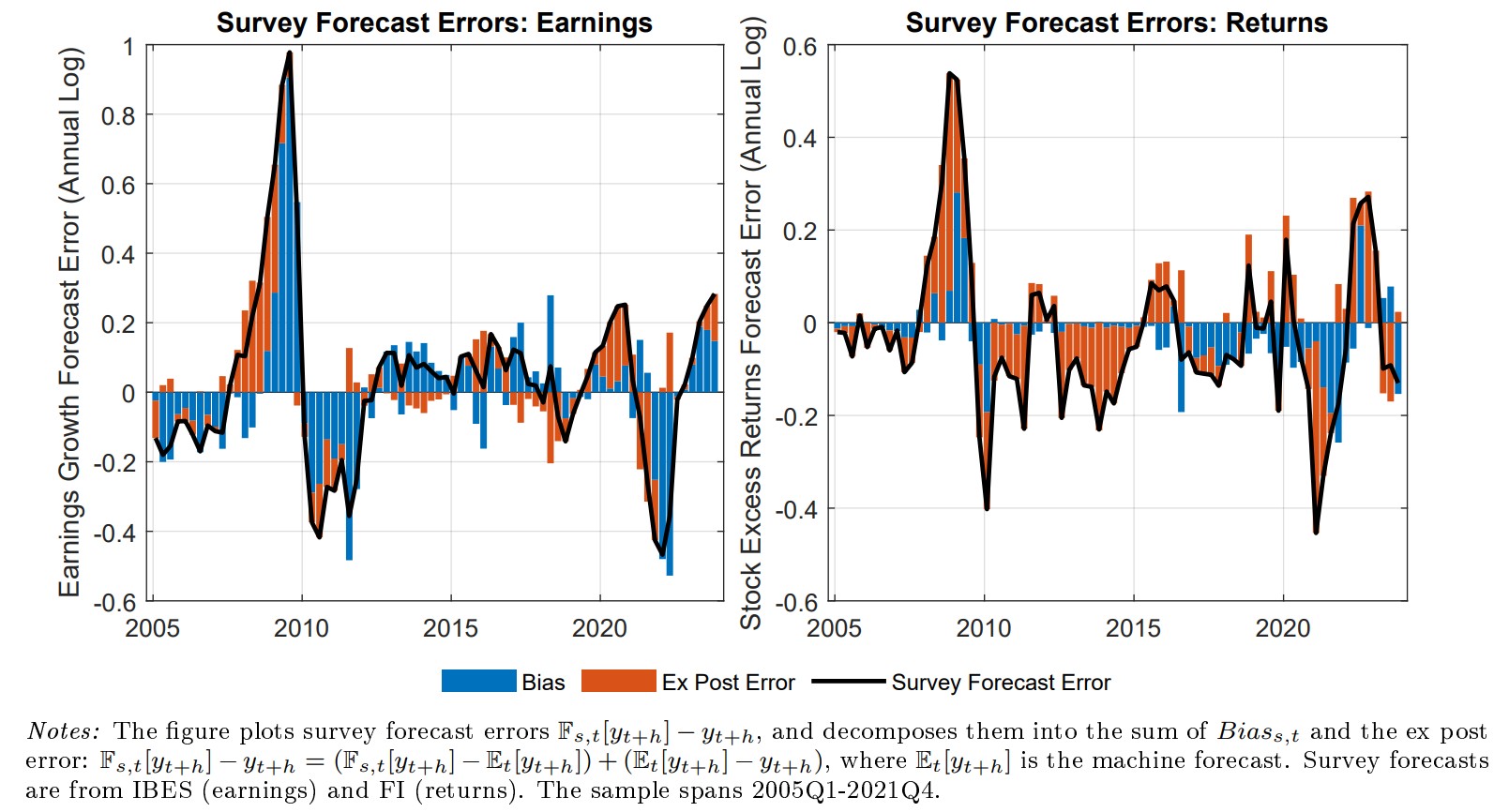

This paper studies the dynamics of asset prices and unemployment when expectations deviate from a rational benchmark. Using machine learning forecasts as a benchmark for objective beliefs, I quantify distortions in survey forecasts of firms' future cash flows. Survey forecasts overreact to cash flow news, while machine forecasts do not. These belief distortions explain over 60% of the variation in hiring at both the aggregate and firm levels. Following positive idiosyncratic shocks to their cash flows, firms with distorted beliefs overhire relative to firms with objective beliefs, while their stock returns initially overshoot and subsequently reverse. A search model in which firms learn about cash flows with fading memory reproduces not only the overreaction in beliefs but also the resulting volatility in asset valuations and unemployment. Distorted beliefs that raise asset valuations also raise the value firms attach to new hires, leading stock prices and hiring to move together.

Working Papers

The Prestakes of Stock Market Investing

(with Francesco Bianchi, Sydney Ludvigson, and Sai Ma)

NBER Working Paper No. 34420, 2025

[Abstract] [PDF] [Working Paper]

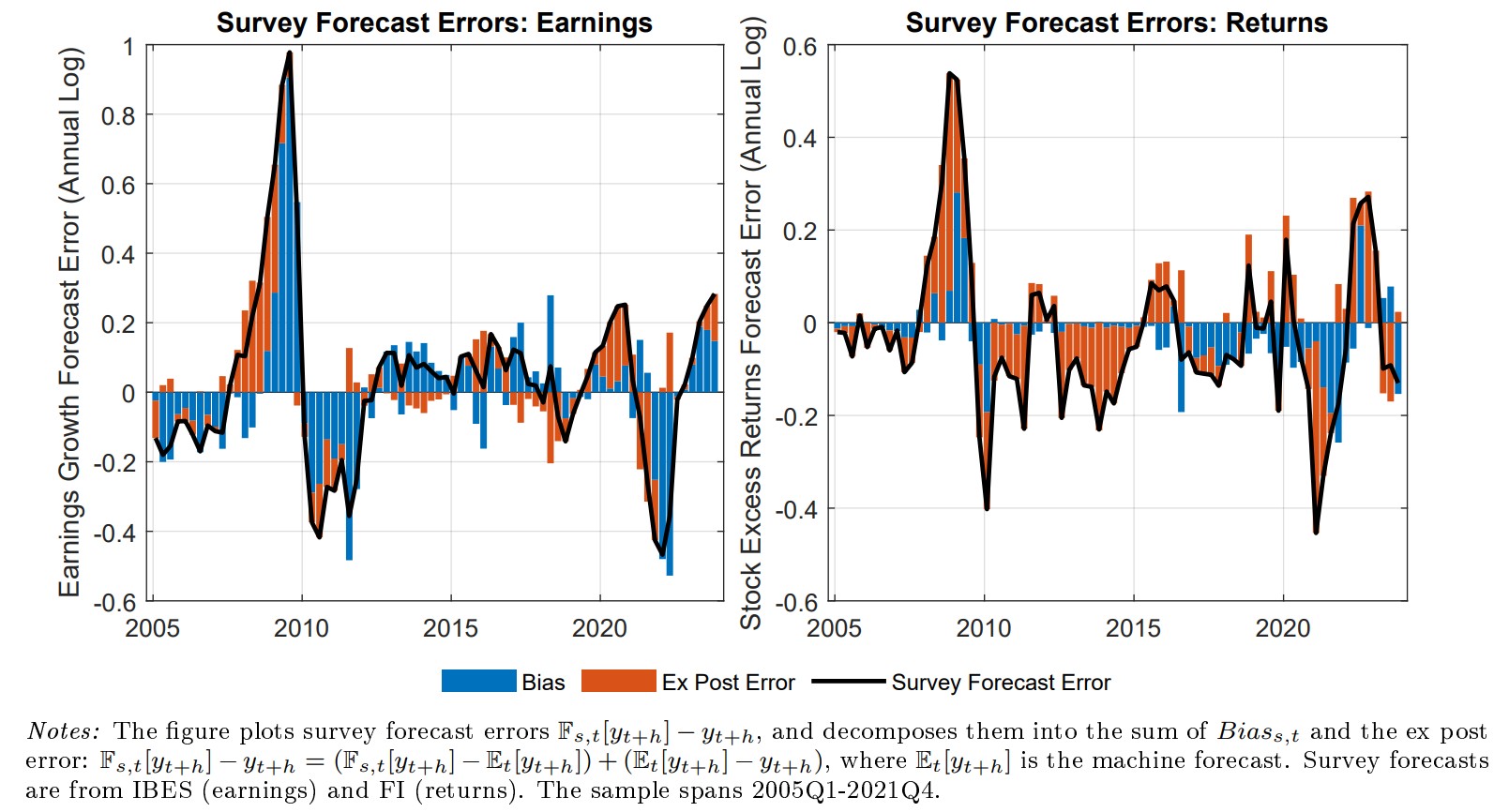

How rational is the stock market and how efficiently does it process information? We use machine learning to establish a practical measure of rational and efficient expectation formation while identifying distortions and inefficiencies in the subjective beliefs of market participants. The algorithm independently learns, stays attentive to fundamentals, credit risk, and sentiment, and makes abrupt course-corrections at critical junctures. By contrast, the subjective beliefs of investors, professionals, and equity analysts do little of this and instead contain predictable mistakes–prestakes–that are especially prevalent in times of market turbulence. Trading schemes that bet against prestakes deliver defensive strategies with large CAPM and Fama-French 5-factor alphas.

Inflation and Labor Markets: A Bottom-Up View

(with Sophia Chen, Deniz Igan, and Prachi Mishra)

IMF Working Paper No. 220, 2024

[Abstract] [PDF] [Working Paper]

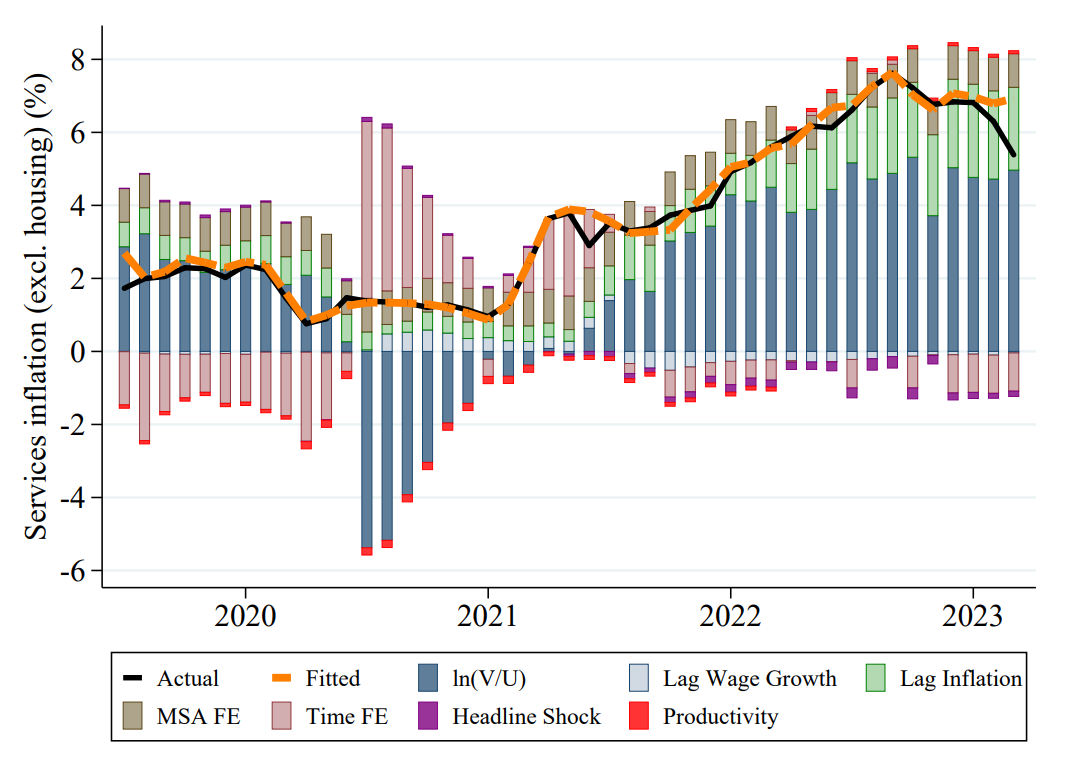

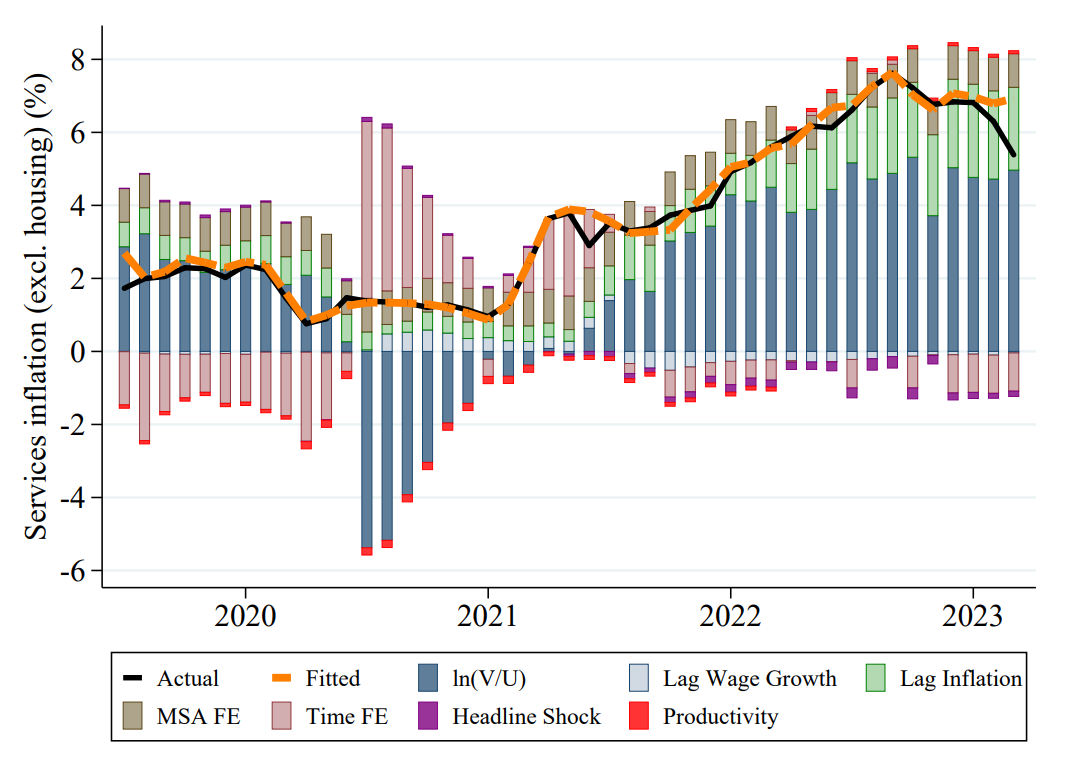

U.S. inflation surged in 2021-22 and has since declined, driven largely by a sharp drop in goods inflation, though services inflation remains elevated. This paper zooms into services inflation, using proprietary microdata on wages to examine its relationship with service sector wage growth at the Metropolitan Statistical Area (MSA) level. We estimate the wage-price pass-through with a local projection instrumental variable model that exploits variation in labor market tightness across MSAs. Our findings reveal a positive and significant relationship between wages and price growth, with a lag. This suggests that the effects of tight labor markets are persistent and may influence the pace of progression toward the inflation target.

Divergence in Post-Pandemic Earnings Growth: Evidence from Micro Data

(with Sophia Chen)

IMF Working Paper No. 222, 2024

[Abstract] [PDF] [Working Paper]

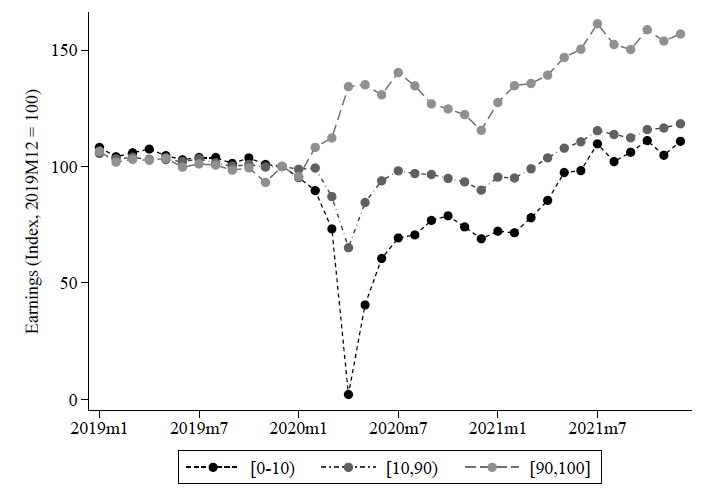

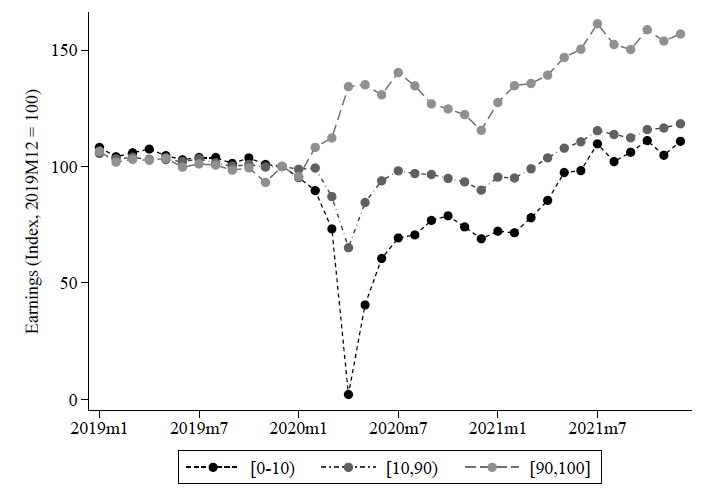

We analyze post-pandemic labor earnings using employer-employee data and find that earnings grew faster in counties with tighter labor markets and with greater access to loans through the Paycheck Protection Program (PPP), with the impact of PPP loans especially pronounced in areas with tighter labor markets. This divergence in earnings growth is particularly large for lower-paid, nonmanagerial workers, and those employed in smaller firms. Both wage increases and additional hours worked contributed to the overall growth in earnings. These findings align with a labor market competition framework, where tight labor markets reduce earnings disparities. Access to credit further strengthens the competition by relaxing firms' financing constraints.

Zombies on the Brink: Evidence from Japan on the Reversal of Monetary Policy Effectiveness

(with Gee Hee Hong and Deniz Igan)

BIS Working Paper No. 987, 2022

[Abstract] [PDF] [Working Paper]

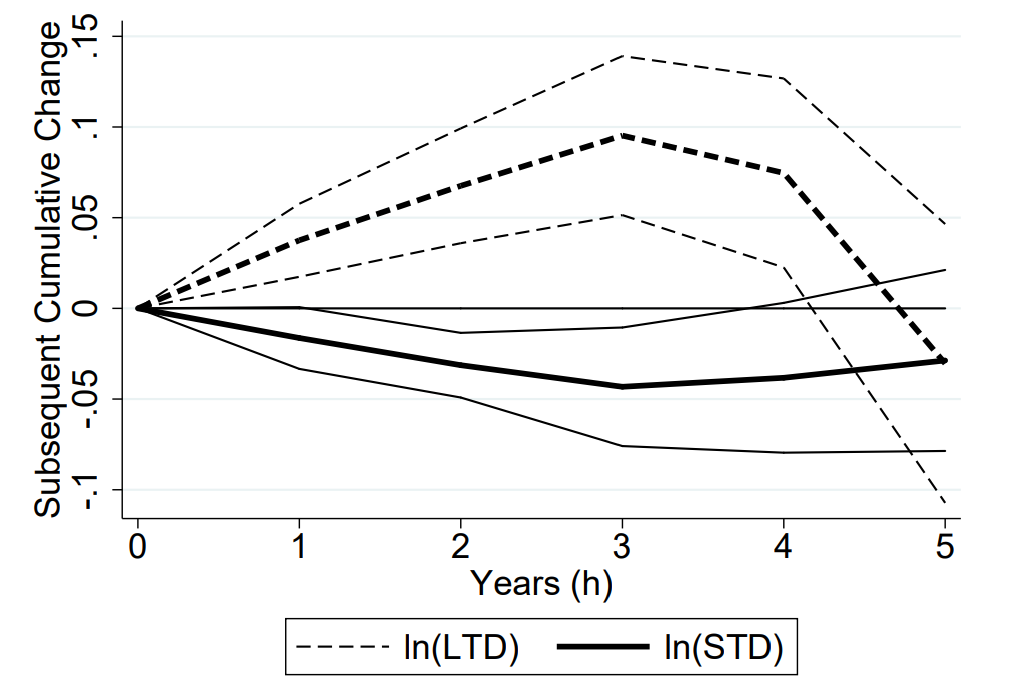

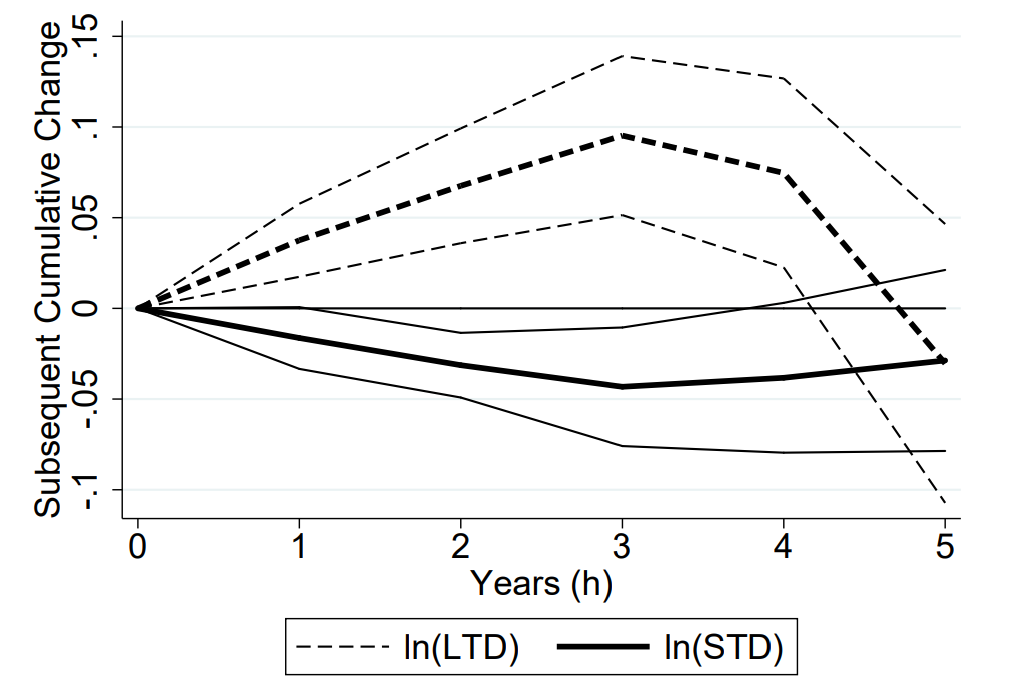

How does unconventional monetary policy affect corporate capital structure and investment decisions? We study the transmission channel of quantitative easing and its potential diminishing returns on investment from a corporate finance perspective. Using a rich bank-firm matched data of Japanese firms with information on corporate debt and investment, we study how firms adjust their capital structure in response to the changes in term premia. Investment responds positively to a reduction in the term premium on average. However, there is a significant degree of cross-sectional variation in firm response: healthier firms increase capital spending and cash holdings, while financially vulnerable firms take advantage of lower long-term yields to refinance without increasing investment.

Publications

Small and Vulnerable: Small Firm Productivity in the Great Productivity Slowdown

(with Sophia Chen)

Journal of Financial Economics, 2023, 147(1): 49-74

[Abstract] [PDF] [DOI] [Working Paper] [Code and Data]

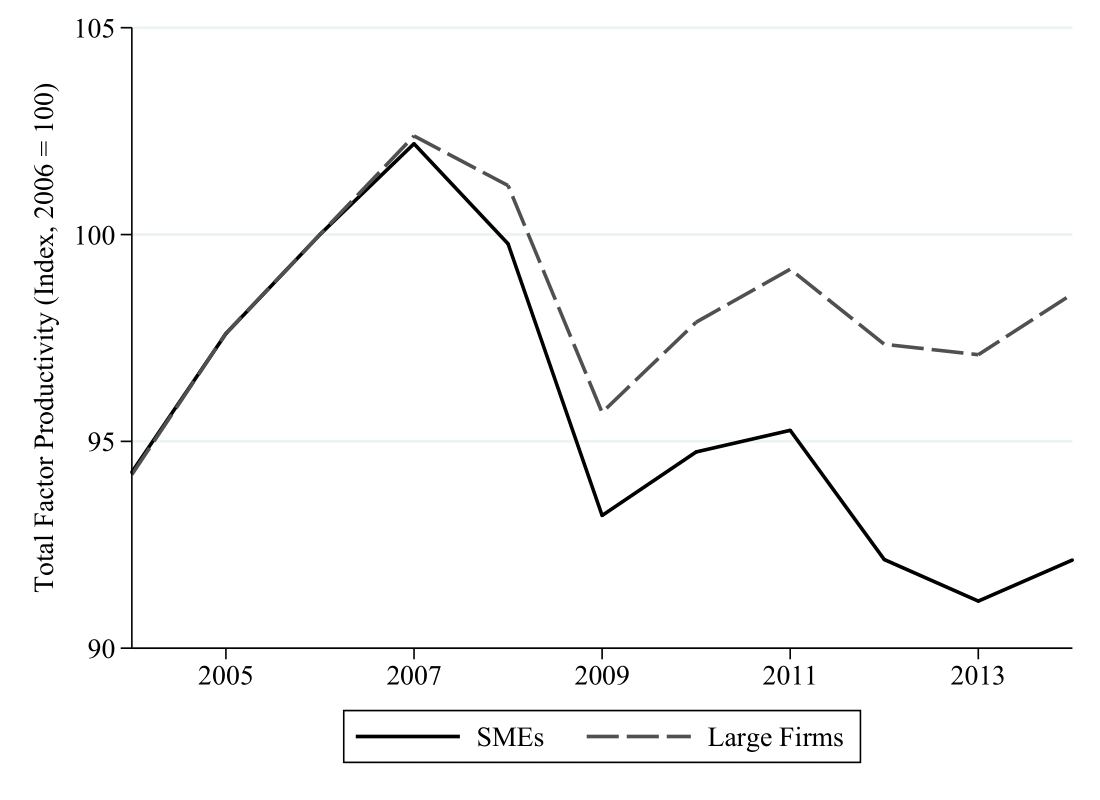

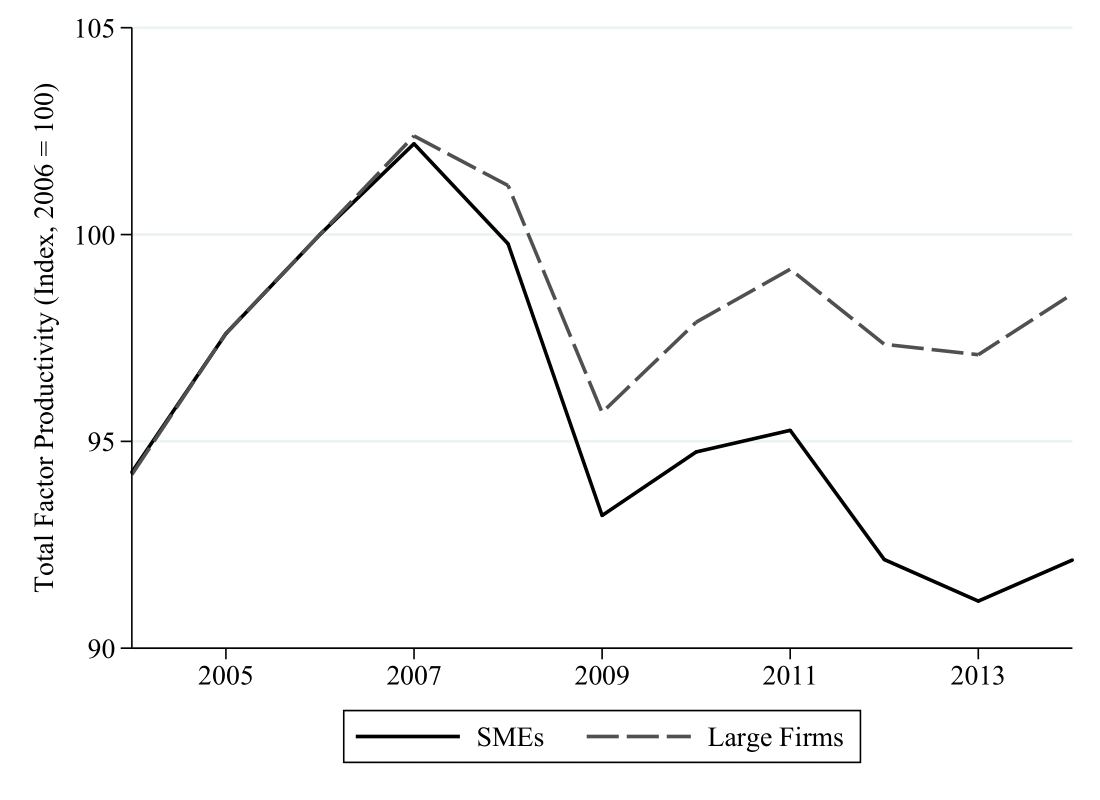

We show that the TFP growth of European micro, small, and medium-sized firms (SMEs) diverged from large firms after the global financial crisis. The average post-crisis TFP growth of medium-sized, small, and micro firms was, respectively, 1.1, 2.9, and 5.4 percentage points lower than that of large firms. This SME productivity gap is larger for firms with more severe credit supply shocks. The gap is partially attributable to a larger post-crisis reduction in intangible capital at SMEs than at large firms. Horseraces suggest that SME indicators are more robust and more powerful predictors of post-crisis TFP growth than other indicators.

Demand Conditions and Worker Safety: Evidence from Price Shocks in Mining

(with Kerwin Charles, Matthew Johnson, and Mel Stephens)

Journal of Labor Economics, 2022, 40(1): 47-94

[Abstract] [PDF] [DOI] [Working Paper] [Code and Data]

Media: [Yale Insights]

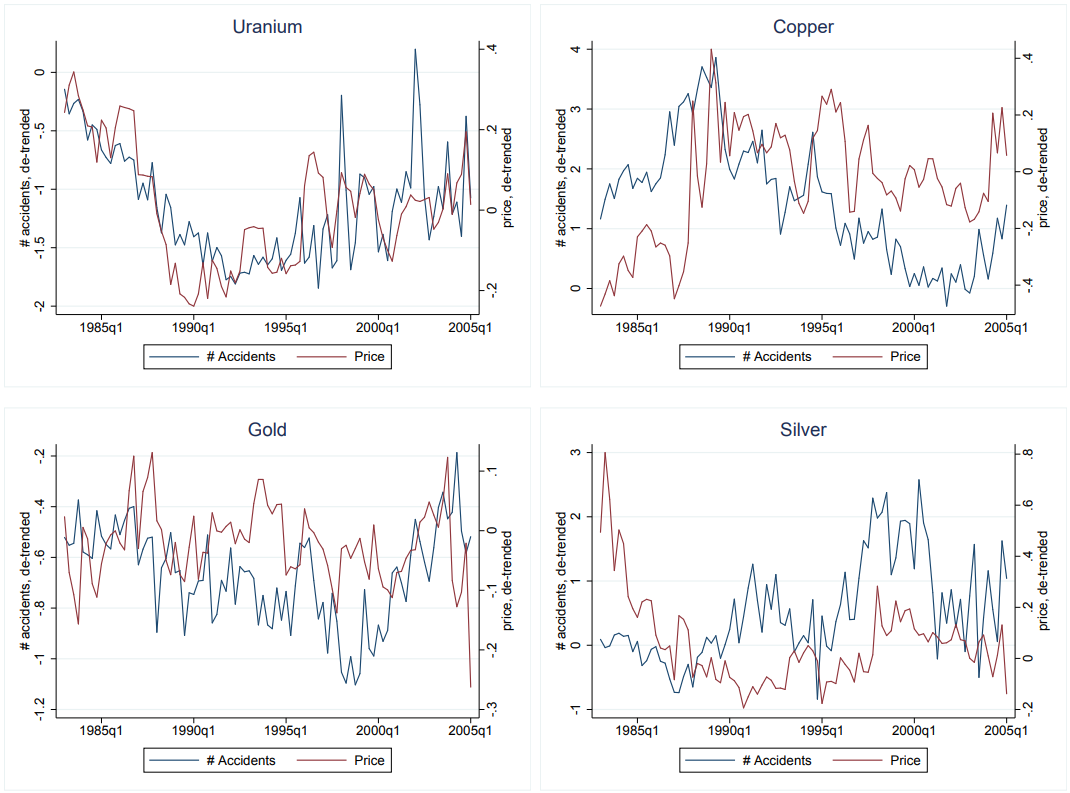

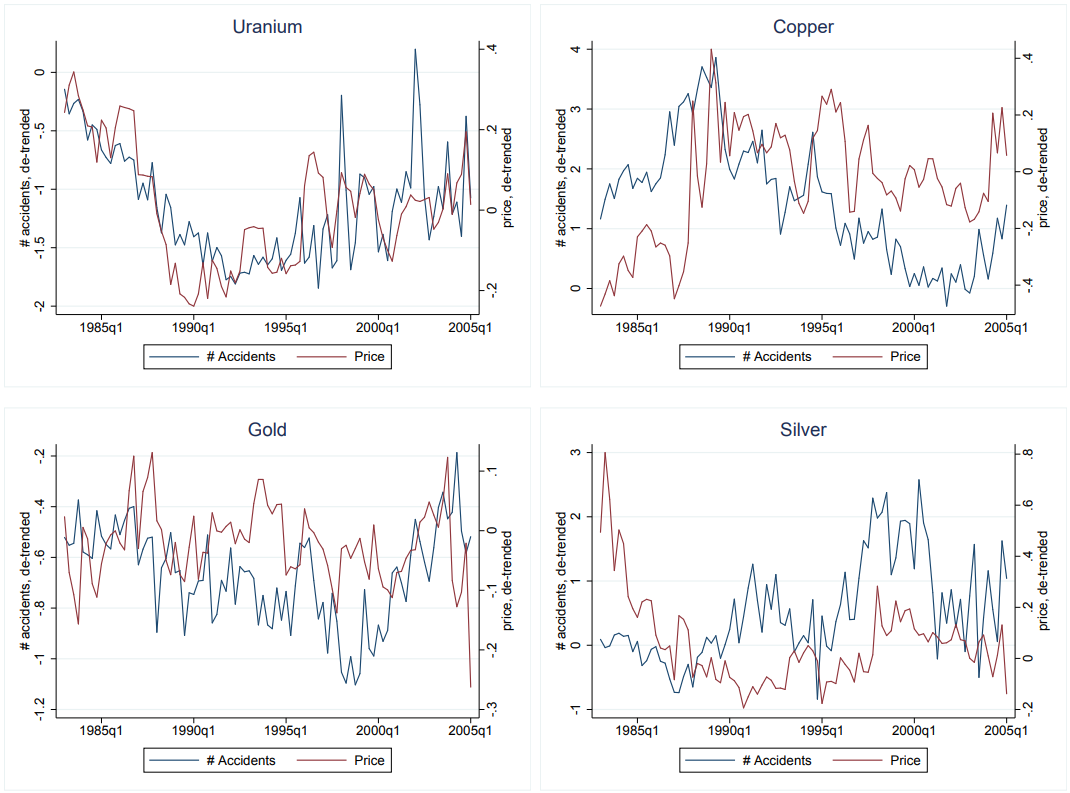

We investigate how demand conditions affect employers' provision of safety—something about which theory is ambivalent. Positive demand shocks relax financial constraints that limit safety investment but simultaneously raise the opportunity cost of increasing safety rather than production. We study the US metals mining sector, leveraging exogenous demand shocks from short-term variation in global commodity prices. We find that positive price shocks substantially increase workplace injury rates and safety regulation noncompliance. While these results indicate the general dominance of the opportunity cost effect, shocks that only increase mines' cash flow lower injury rates, illustrating that financial constraints also affect safety.

Media Sentiment and International Asset Prices

(with Samuel Fraiberger, Damien Puy, and Romain Ranciere)

Journal of International Economics, 2021, 133(C): 103526

[Abstract] [PDF] [DOI] [Working Paper] [Code and Data]

Media: [IMF Blog] [IMF Research Perspectives]

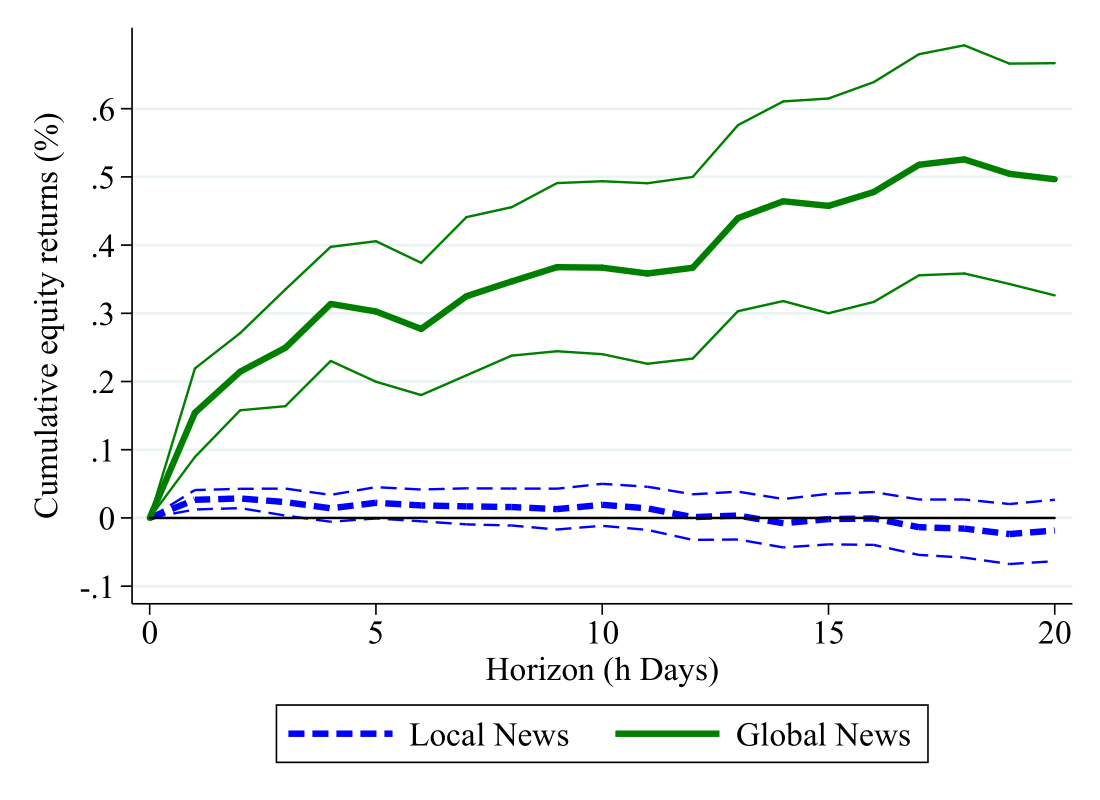

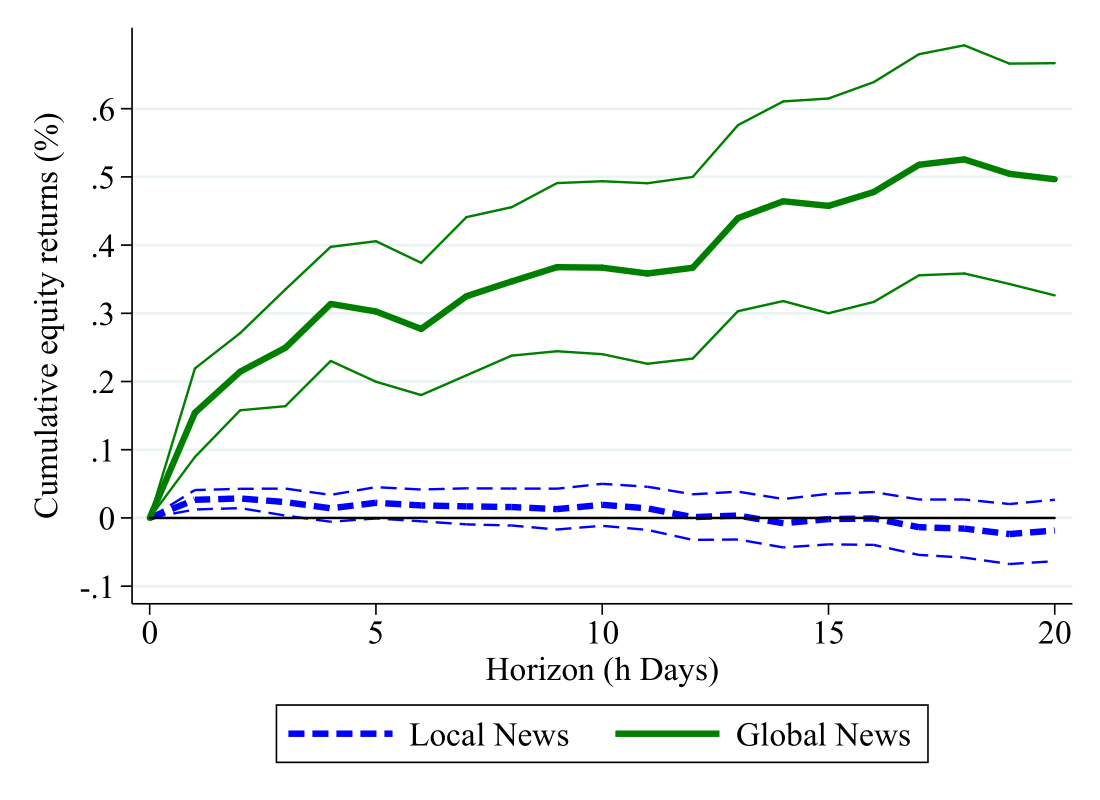

We investigate the relationship between media sentiment and international equity prices using a new dataset of 4 million news articles published between 1991 and 2015. Three key results emerge. First, news sentiment robustly predicts future daily returns around the world. However, we find a sharp contrast between the effect of local news and that of global news: whereas local news optimism (pessimism) predicts a small and transitory increase (decrease) in local equity returns, global news sentiment has a larger impact on returns that does not reverse in the short run. Second, news sentiment affects local prices mainly through the investment decisions of foreign—rather than local—investors. Third, large variations in global news sentiment predominantly happen in the absence of new information about fundamentals, suggesting that movements in global sentiment capture variations in investors' sentiment. Taken together, our findings illustrate the key role played by foreign news and investors' sentiment in driving local asset prices.

Can Social Media Reliably Estimate Unemployment?

(with Samuel Fraiberger, Nir Grinberg, Boris Sobol, and Manuel Tonneau)

PNAS Nexus, 2025, 4(12): pgaf309

[Abstract] [PDF] [DOI] [Supplementary Materials] [Code and Data]

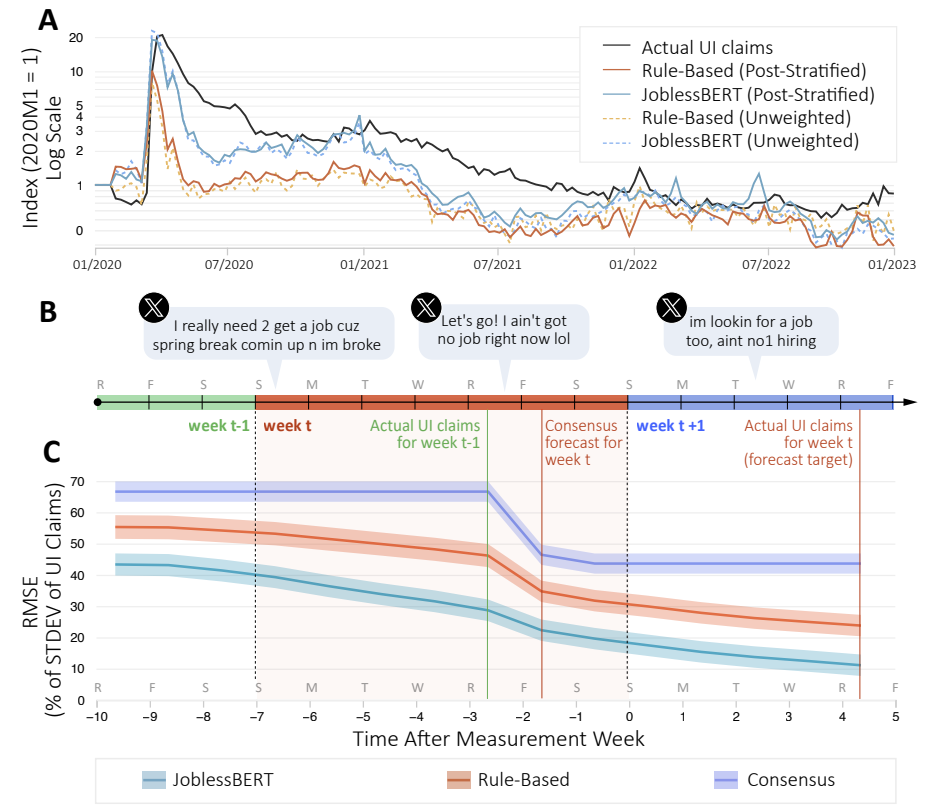

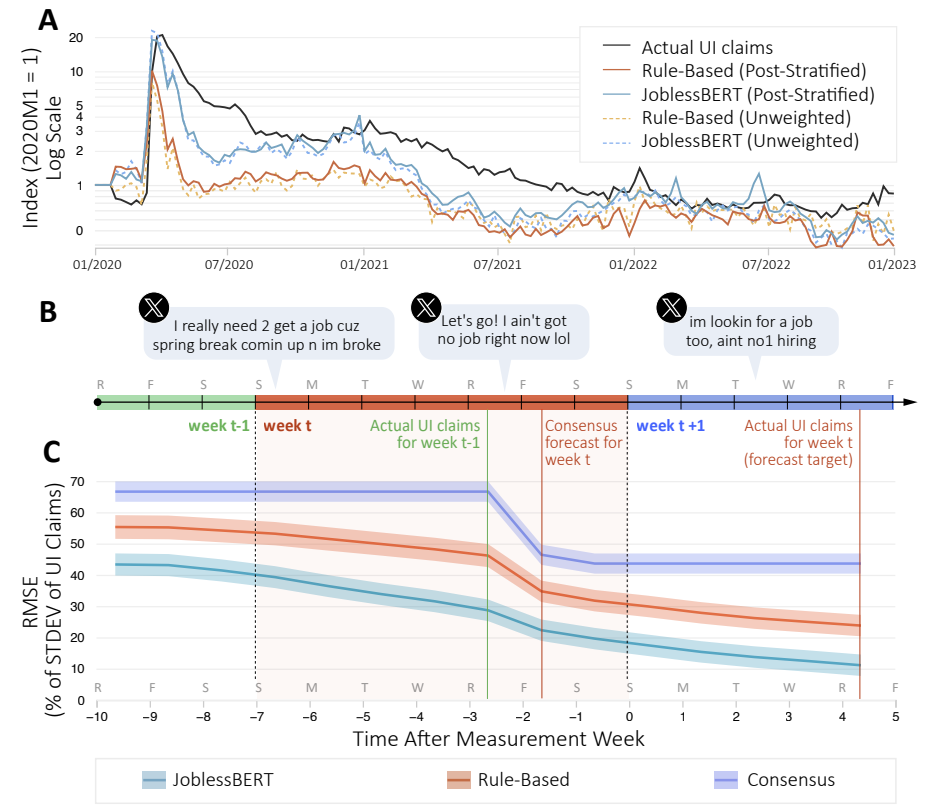

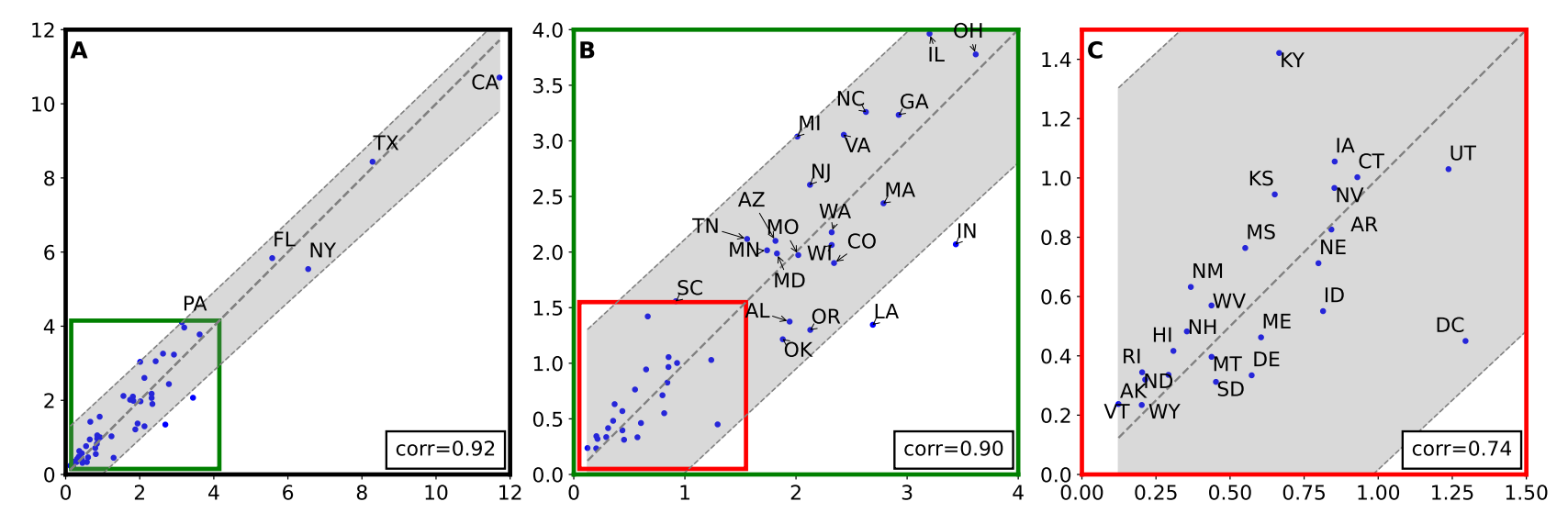

Digital trace data holds tremendous potential for measuring policy-relevant outcomes in real-time, yet its reliability is often questioned. Here, we propose a principled yet simple approach: capturing individual disclosures of unemployment using a fine-tuned artificial intelligence (AI) model and post-stratification adjustment using inferred user demographics. We show that our methodology consistently outperforms the industry's forecasting average, and can improve the predictions of U.S. unemployment insurance claims, up to two weeks in advance, at the national, state, and city levels at both turbulent and stable times. The results demonstrate the potential of combining AI models with statistical modeling to complement traditional survey methodology, and contribute to better-informed policymaking, especially at turbulent times.

280 Characters to Employment: Using Twitter to Quantify Job Vacancies

(with Boris Sobol, Manuel Tonneau, Samuel Fraiberger, and Nir Grinberg)

Proceedings of the International AAAI Conference on Web and Social Media, 2024, 18(1), 1477-1489

[Abstract] [PDF] [DOI] [Code and Data]

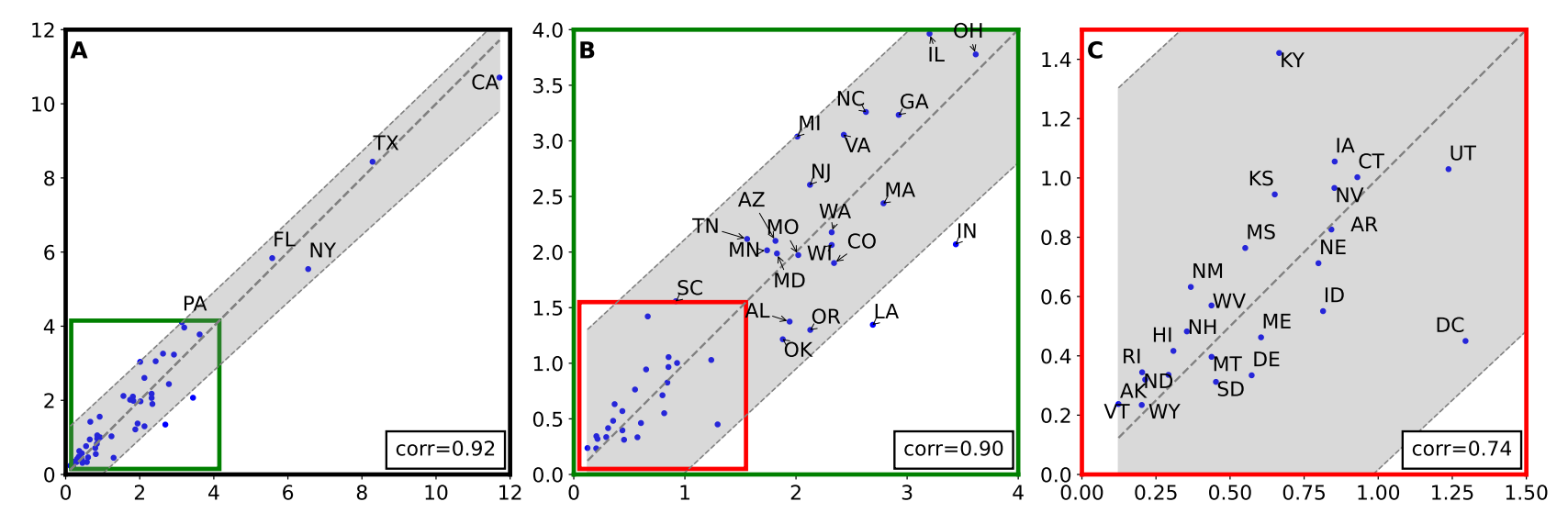

Accurate assessment of workforce needs is critical for designing well-informed economic policy and improving market efficiency. While surveys are the gold standard for estimating when and where workers are needed, they also have important limitations, most notably their substantial costs, dependence on existing and extensive surveying infrastructure, and limited temporal, geographical, and sectorial resolution. Here, we investigate the potential of social media to provide a complementary signal for estimating labor market demand. We introduce a novel statistical approach for extracting information about the location and occupation advertised in job vacancies posted on Twitter. We then construct an aggregate index of labor market demand by occupational class in every major U.S. city from 2015 to 2022, which we evaluate against two sources of official statistics and an index from a large aggregator of online job postings. We find that the newly constructed index is strongly correlated with official statistics and, in some cases, advantageous compared to statistics from job aggregators. Moreover, we demonstrate that our index can robustly improve the prediction of official statistics across occupations and states.

Education

- Ph.D. in Economics, New York University, 2026 (Expected)

- B.A. in Economics and B.S. in Mathematics, University of Chicago, 2017

- Diploma, Daewon Foreign Language High School, 2011

Teaching

Applied Statistics & Econometrics I-II (Master’s)

Teaching Assistant, NYU, 2021–2023

Professors: Banani Nandi, Bruce McNevin, Elena Goldman

Intermediate Macroeconomics (Undergraduate)

Teaching Assistant, NYU, 2020

Professor: Jess Benhabib